The Americas

Don Enrique Copper Project (EVR:50%)

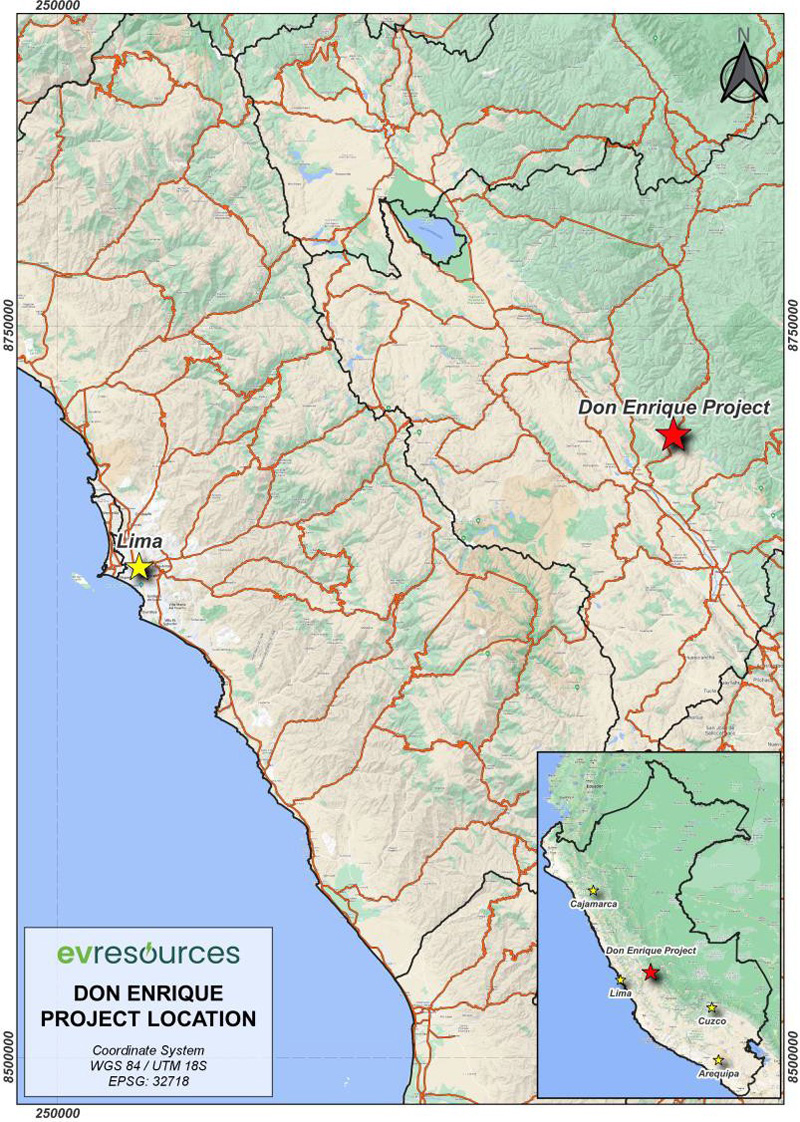

The project consists of 4 licences covering 1,800Ha, in an area 21km northeast of Jauja, and approximately 260km from the Nation’s capital, Lima:

- Don Enrique, Licence number: 0100769-12, 1000 Ha.

- Chaupiloma 2007, Licence Number: 0105549-07, 100 Ha.

- Chaupiloma 2008, Licence Number: 0101581-08, 100 Ha.

- COCOA BEACH, Licence Number: 010155815, 600 Ha.

Exploration

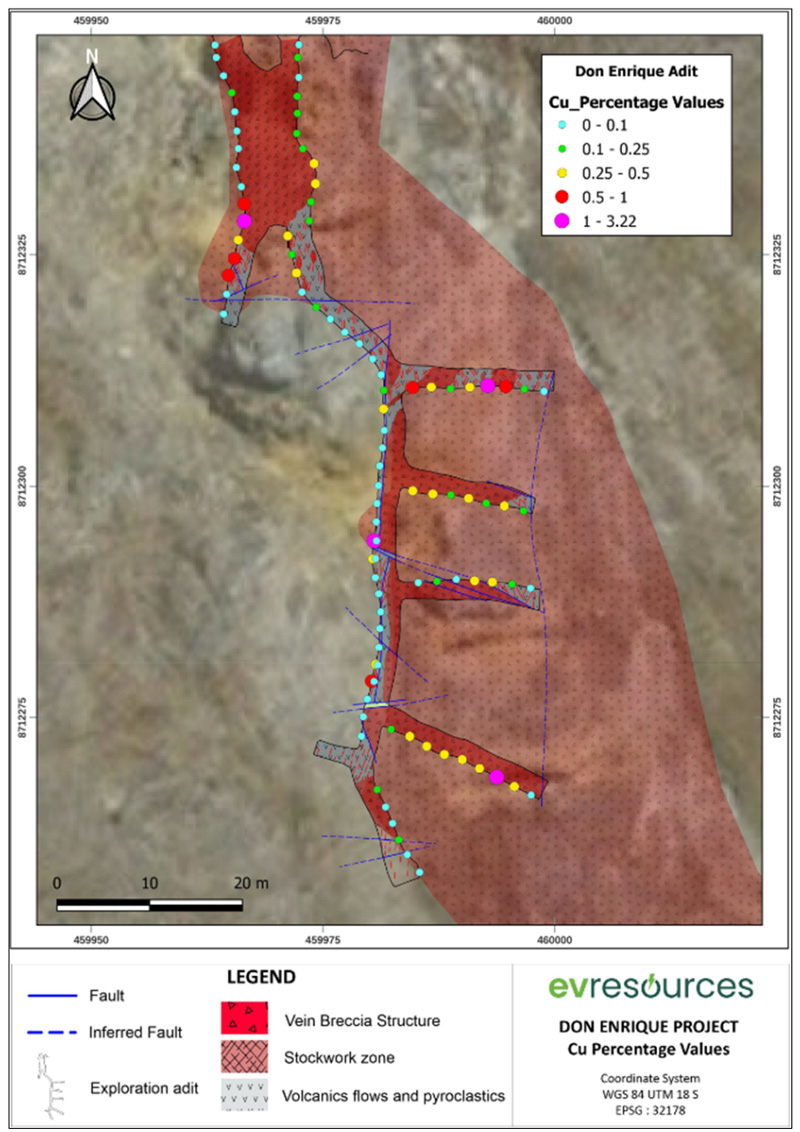

A programme of channel sampling taken from within, and around an old underground exploration drive and crosscut at the Don Enrique copper project in Jauja Province, Peru, has been completed and results received.

28 of the 108 samples demonstrate copper values greater than 0.30% and up to 3.22% Cu.

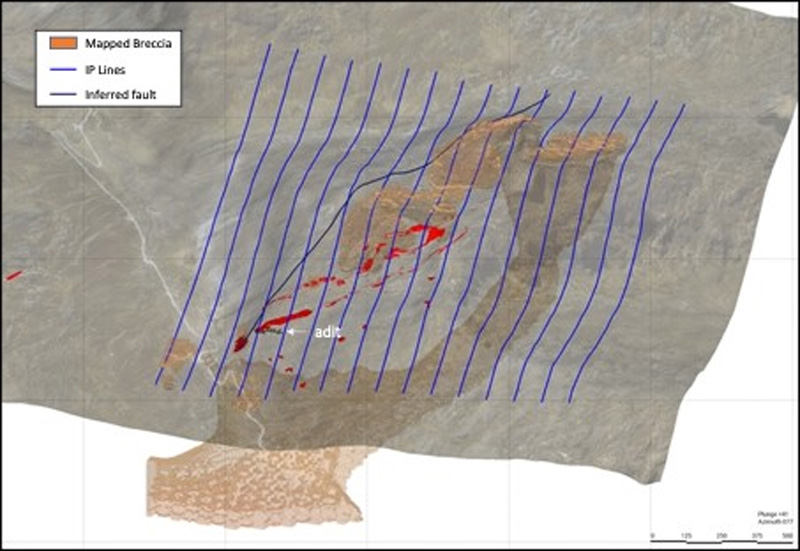

A Geophysics programme consisting of 28.8-line km of IP, and 46.8-line km of magnetics was completed, and confirmed a substantial sulphide orebody is present over a strike of up to 1200m, with two parallel structures of up to 30m in width for much of the strike, to an interpreted depth of 500m.

The results confirm a substantial porphyry drilling target which will be tested by a 2,500m diamond drilling programme at the end of the September quarter, subject to drill permitting.

Geology

Country rocks of the district consist of a sequence of clastic sediments, mainly sandstones and argillaceous shales, and pyroclastic volcanics and andesitic flow-porphyries. The sediments and volcanics are folded, faulted and intruded by a complex-igneous intrusive, varying in composition from microdiorite to dacite. These units have been later intruded by narrow felsic (aplitic) dykes. The sedimentary-volcanic sequence is known in central Perú as the “Permian Mitu Group”, and the volcanic unit as “Catalina Volcanics”. The area is crossed diagonally by a large regional fault zone, striking NW-SE, and can be followed for at least 40km.

At the main Don Enrique Prospect, copper-gold-silver mineralisation is hosted by two parallel, subvertical to steeply east dipping, hydrothermal breccia structures that range from 5m to 20m in width and are separated by a 90m wide zone of andesite.

As observed in the underground adit (Zone 1), vein material is composed in part of massive sulphides with patches and pods of quartz and calcite veinlets. Sulphides mainly comprise a mixture of patches of chalcopyrite, minor bornite together with scattered molybdenite, some galena and rare sphalerite. At the hanging-wall of the vein there is a zone more than 2m thick of hydrothermal breccia composed of altered rock-fragments with disseminated sulphides, and quartz fragments in a matrix of argillised and silicified materials with milky quartz and calcite veinlets.

At surface, Zone 1 crops-out discontinuously over widths of 15m to 20m for about 1km showing abundant iron oxides and traces of remnant sulphide within milky quartz. Zone 2 can be traced as almost continuous outcrop for 1.2 to 1.5km over 5 to 10m widths as milky quartz, hosting some scattered old small pits and trenches.

The breccia bodies and veining are interpreted to extend from surface to the valley floor, a vertical distance of 300m. There is no evidence of drilling at the prospect, hence it is unknown whether observed mineralisation is continuous from surface to the adit level.

Transaction Terms

EV Resources entered into two binding agreements to purchase 100% of Minera Montserrat S.A.C, (Montserrat), a Peruvian company incorporated under the company reference number RUC Nº 20554377425 and 100% owner of the Don Enrique Project. The first agreement is with a group of private unrelated individuals (Vendor 1), to purchase 50% of the shares in Montserrat immediately. The second agreement is with a private unrelated individual (Vendor 2), for the payment of an option fee to acquire the remaining 50% of the shares in Montserrat within a 2-year period from the date of signature.

Under the agreements EV Resources has agreed to acquire 100% of Montserrat on the following transaction terms:

- Upon signing the first agreement, payment of US$150,000 in cash to buy 50% of the shares of Montserrat from Vendor 1;

- Upon signing the second agreement, payment of US$150,000 in cash to buy an option over the remaining 50% of the shares of Montserrat from Vendor 2;

- Up until the 24-month anniversary of signing the agreement, EV Resources has the option to acquire 50% of the shares of Montserrat for the sum of US$850,000 (“Option”); and

- A 1% NSR shall be payable to the Vendor 2.